Photography Sage

Your guide to capturing moments and mastering photography skills.

Insurance Savings Jackpot: Discover Hidden Discounts

Unlock big savings on your insurance! Discover hidden discounts and start saving today with our ultimate guide to insurance savings jackpots.

Unlocking the Secrets: How to Find Hidden Discounts in Your Insurance Policy

Many policyholders are unaware that their insurance policies may contain hidden discounts that can significantly lower their premiums. A good starting point for discovering these discounts is to carefully review your policy documents, including the declaration pages and endorsements. Look for sections that mention loyalty discounts, bundling offers, or claims-free rewards. Additionally, contacting your insurance agent to discuss your coverage can provide insights into any potential savings that might apply specifically to your situation.

Another effective way to unearth hidden discounts is by taking advantage of available discounts for safety features. For instance, if you've recently installed security systems, smoke detectors, or other safety devices, notify your insurer, as these could qualify you for premium reductions. Moreover, participating in safe driving courses can often lead to reductions in auto insurance rates. By proactively seeking out these opportunities and asking questions, you can ensure you're maximizing your savings and not leaving money on the table.

Maximize Your Savings: A Step-by-Step Guide to Uncovering Insurance Discounts

Finding ways to maximize your savings on insurance can make a significant difference in your monthly budget. Start by reviewing your current policies and assess your coverage needs. You may discover that you are paying for services or features you no longer need. Next, contact your insurance provider to inquire about available discounts. Many companies offer discounts for bundling multiple policies, maintaining a good driving record, or being a member of certain organizations. By systematically checking for these opportunities, you can start to reduce your premium costs effectively.

Another way to uncover insurance discounts is by investing a little time in research. Utilize online comparison tools to explore different insurance providers and their offered rates. Consider factors such as loyalty rewards for long-standing customers and discounts for completing safety courses or installing security devices. Additionally, don't hesitate to negotiate with your insurer; presenting quotes from competitors can sometimes lead to favorable adjustments to your policy rates. By following these steps, you can confidently navigate the insurance landscape and significantly enhance your savings.

Are You Missing Out? Common Insurance Discounts You Didn't Know Existed

Many people often overlook insurance discounts that could save them significant amounts of money. It's surprising how many options are available that can drastically reduce your premiums. For instance, did you know that bundling multiple policies—such as your home and auto insurance—can lead to substantial savings? Multi-policy discounts are one of the most common and yet least utilized discounts available. Additionally, taking advantage of safe driver discounts can reward you for maintaining a clean driving record, further cutting down your expenses.

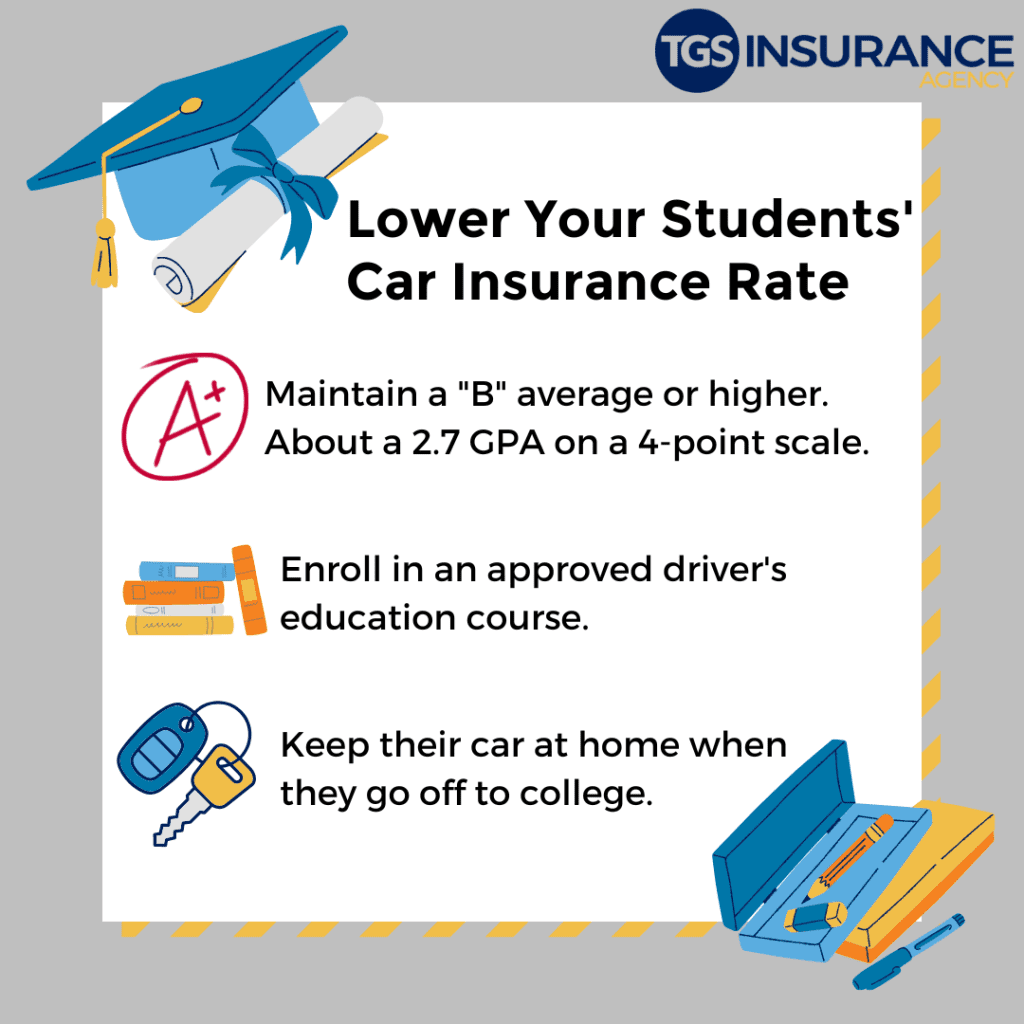

Aside from the obvious options, there are a few lesser-known insurance discounts that many policyholders are simply unaware of. For example, some insurers offer discounts for installing safety features in your vehicle or home, such as alarms or anti-theft devices. Another often-missed opportunity is the loyalty discount, which can be granted to long-term customers as a token of appreciation. Lastly, students may qualify for discounts through their academic achievements or for being away at college, which decreases their risk profile. Taking the time to ask your insurance provider about these options could lead you to significant savings.