Photography Sage

Your guide to capturing moments and mastering photography skills.

Dollars and Sense: How to Cash In on Auto Insurance Discounts

Unlock hidden savings! Discover top auto insurance discounts and start cashing in today with our expert tips in Dollars and Sense.

Unlocking Savings: A Guide to Finding Auto Insurance Discounts

Finding ways to save on auto insurance can be overwhelming, but understanding auto insurance discounts can simplify the process. Companies offer a variety of discounts, often depending on factors such as your driving record, the vehicle you drive, and your personal circumstances. To start, make sure to inquire about the following common discounts:

- Safe Driver Discounts: Many insurers reward policyholders with a clean driving record.

- Multi-Policy Discounts: Bundling your auto insurance with other policies, like home or renters insurance, can lead to significant savings.

- Low Mileage Discounts: If you don’t drive much, you may qualify for a discount.

- Good Student Discounts: Young drivers who maintain a high GPA can often get reduced rates.

Additionally, don’t forget to explore other potential auto insurance discounts that may be available to you. For instance, taking a defensive driving course could earn you a reduction in your premiums, as it demonstrates your commitment to safe driving. Furthermore, being a member of certain organizations or alumni groups may also provide access to exclusive discounts. Always remember to compare rates from multiple insurers and ask about any new or hidden discounts that might apply to your specific situation. Being proactive in your search can uncover significant savings, making it worth your time in the end.

10 Common Auto Insurance Discounts You Might Be Missing

When it comes to saving money on your auto insurance, many drivers overlook the various discounts that could significantly lower their premiums. Auto insurance discounts come in many forms, and understanding what you might qualify for can lead to substantial savings. Here are ten common auto insurance discounts that you shouldn't miss:

- Safe Driver Discount: If you have a clean driving record with no accidents or violations, you may qualify for a safe driver discount.

- Bundling Discount: Consider bundling your auto insurance with other policies, like home or renter's insurance, to receive a reduced rate.

- Good Student Discount: Full-time students with a GPA of 3.0 or higher may be eligible for a discount based on their academic performance.

- Low Mileage Discount: If you drive fewer miles than the average, you could qualify for this discount since lower mileage generally means less risk.

- Military Discount: Active duty and veteran military members often receive special rates on their auto insurance policies.

- Senior Discount: Seniors may receive discounts based on their age and driving experience.

- Defensive Driving Course Discount: Completing a recognized defensive driving course may also qualify you for a discount.

- Occupation Discount: Some insurers offer discounts for certain professions, such as teachers or nurses, recognizing their responsible lifestyles.

- Pay-in-Full Discount: If you choose to pay your premium in full rather than in installments, you can often save money.

- Electronic Payment Discount: Using electronic funds transfers for your monthly payments can earn you a discount.

How Do Auto Insurance Discounts Work?

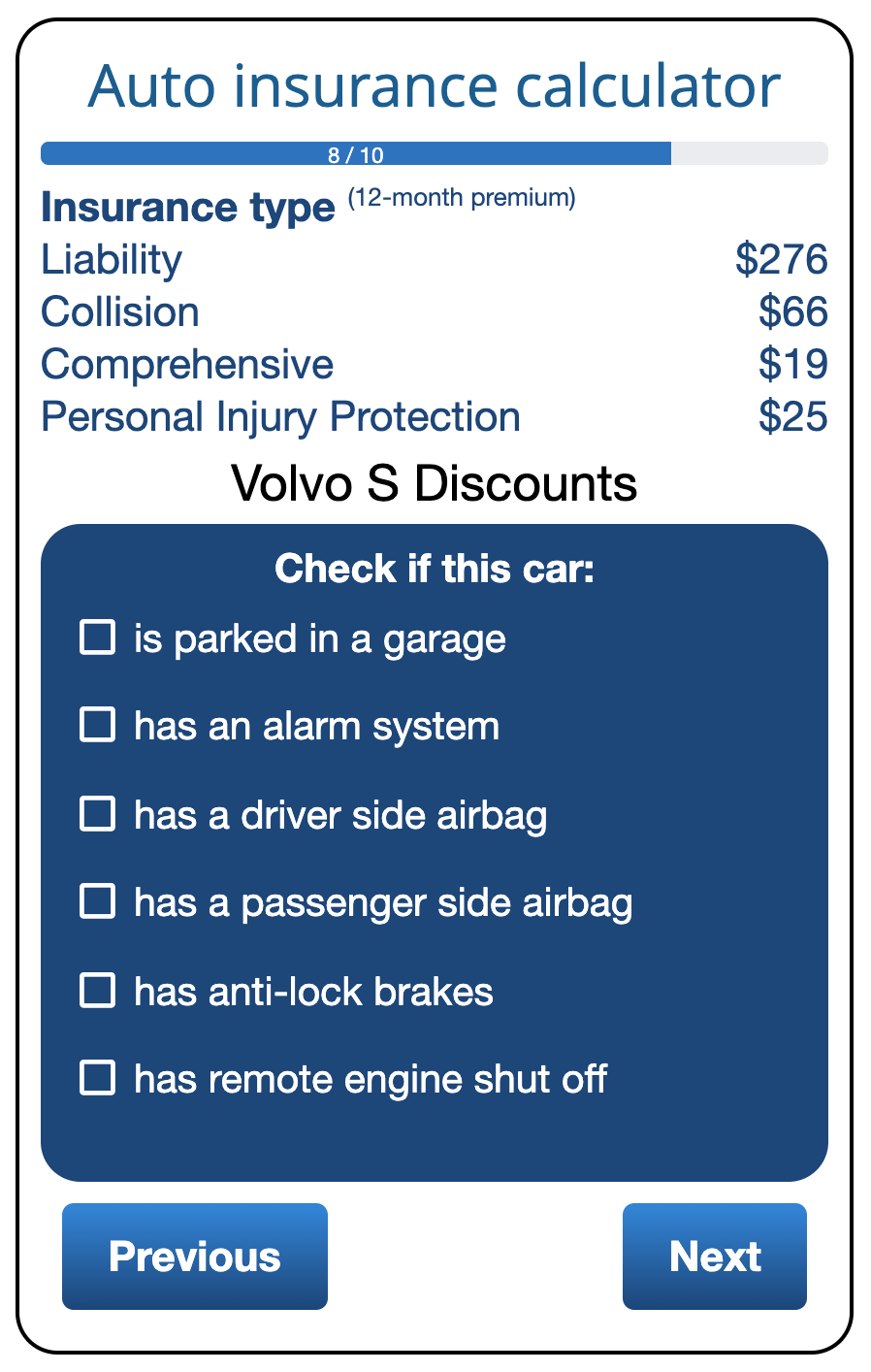

Understanding how auto insurance discounts work can significantly reduce your premium costs. Insurers often provide these discounts as incentives to attract and retain customers who demonstrate safe driving behaviors or low-risk characteristics. Common types of discounts include safe driver discounts, offered to policyholders with a clean driving record, and multi-policy discounts, which benefit those who bundle their auto insurance with other insurance types, such as home or renters insurance. Additionally, discounts may be available for factors like vehicle safety features, low mileage, and good student status for young drivers.

To take advantage of auto insurance discounts, it's crucial to communicate with your insurance provider. Many companies will automatically apply standard discounts, but some may require you to ask or provide documentation. It’s advisable to review your policy periodically and discuss with your agent any changes in your life situation that may qualify you for new discounts. These can include things like moving to a safer neighborhood, completing a defensive driving course, or even your credit score, which may influence your premium rates and available discounts.