Photography Sage

Your guide to capturing moments and mastering photography skills.

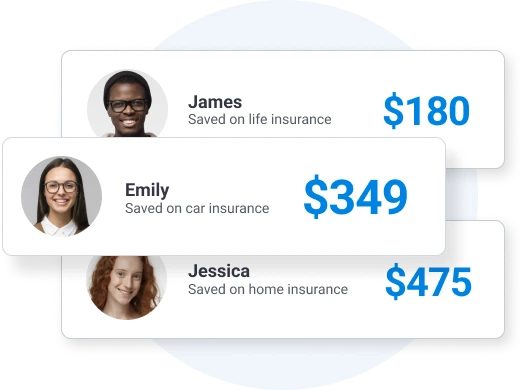

Get Quote-Worthy: Insurance Secrets They Don't Tell You

Unlock the hidden truths of insurance! Discover secrets that can save you money and frustrations—get the best quotes today!

5 Hidden Factors That Affect Your Insurance Premiums

When it comes to determining your insurance premiums, several hidden factors might be lurking beneath the surface that can significantly impact what you pay. For instance, your credit score is one such factor that many people overlook. Insurers often evaluate your credit history to assess risk: a higher credit score may lead to lower premiums, while a poor score can result in increased rates. Additionally, the Consumer Financial Protection Bureau explains how different elements contribute to your score and, in turn, your insurance costs.

Another unexpected factor is your location. Insurance companies take into account the crime rate and the likelihood of natural disasters in your area. For example, homeowners living in regions prone to flooding or wildfires may see a steep increase in their premiums. The National Flood Insurance Program provides insights on how geographical risks can influence insurance rates. Lastly, the type of coverage you choose and your claims history can also play pivotal roles, ensuring you stay informed can help you find ways to manage your costs effectively.

Understanding the Fine Print: What Insurance Policies Really Cover

When diving into the world of insurance policies, it's essential to comprehend the nuances hidden within the fine print. Many people often overlook crucial details, assuming that their coverage is more comprehensive than it actually is. Insurance policies typically outline exclusions, limitations, and conditions that can significantly affect the benefits you receive in case of a claim. Understanding these terms ensures you're not caught off guard when you need to rely on your policy the most.

To truly understand what your insurance policy covers, start by closely reviewing the coverage sections and noting any exclusions. For instance, common exclusions may include natural disasters, pre-existing conditions, or certain types of damage. A holistic understanding of your policy doesn't just enhance your knowledge; it empowers you to navigate claims with confidence. For a deeper insight into policy exclusions and more, check out this resource on insurance exclusions.

Are You Overpaying? Common Insurance Myths Debunked

When it comes to insurance, many consumers believe in pervasive myths that can lead to overpaying for coverage. One common misconception is that higher premiums equal better coverage. In reality, insurance policies vary widely, and an expensive plan does not always provide the best protection for your needs. According to the National Association of Insurance Commissioners, understanding your specific requirements and comparing policies can reveal more affordable options without sacrificing necessary protections.

Another prevalent myth is that all insurance agents provide the same service and pricing. In truth, comparing quotes from multiple providers is crucial to finding the best deal. Many consumers miss out on potential savings by sticking with their long-time provider, which may not offer the most competitive rates. A study by Consumer Reports highlights the significant savings that can be achieved by shopping around. By being proactive and evaluating different options, you can debunk these myths and ensure you are not overpaying for your insurance.